8 6 Preparing a Production Cost Report Weighted Average Cost Accounting

This means gathering the relevant and accurate data from various sources, such as invoices, receipts, timesheets, contracts,…

This means gathering the relevant and accurate data from various sources, such as invoices, receipts, timesheets, contracts, etc. The data should be categorized and classified according to the cost breakdown structure (CBS), which is a hierarchical representation of the different types of costs involved in the project or business. For example, a CBS for a software development project may include categories such as labor, hardware, software, travel, etc.

What is a work-in-process inventory?

- A production manager, on the other hand, might use this data to assess the performance of different production lines or shifts.

- However, if thecompany produces more or fewer units than were produced in May, theunit cost will change.

- The analysis should also identify the root causes and the impacts of the variances, as well as the risks and opportunities for improvement.

- After collecting the cost data from reliable and verifiable sources, the next step is to record and store the cost data in a systematic and secure manner.

- By examining it from various angles and implementing best practices, manufacturers can optimize their operations, reduce costs, and ultimately enhance their market position.

The cost reporting system enabled the company to identify the sources and causes of variance, such as material waste, machine downtime, labor inefficiency, and quality issues. The company then used this information to implement corrective actions, such as improving inventory management, optimizing machine settings, training and motivating workers, and enforcing quality standards. As a result, the company was able to reduce variance costs by 25%, improve product quality by 15%, and increase customer satisfaction by 20%. The cost reporting system also helped the company to evaluate the profitability and competitiveness of each part, and to make informed decisions about pricing, product mix, and market segments.

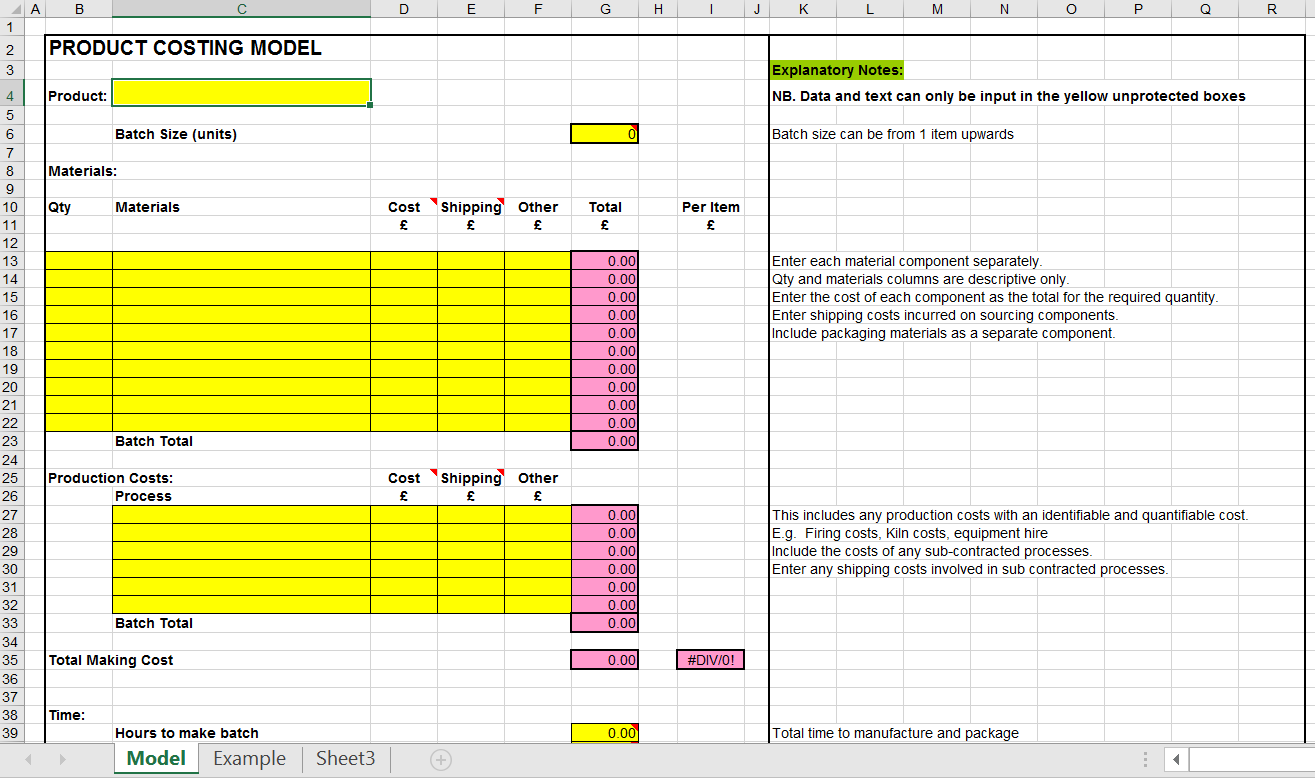

Beware of Fixed Costs

An example of how to use Excel to prepare a production cost report follows. Notice that the basic data are at the top of the spreadsheet, and the rest of the report is driven by formulas. Each month, the data at the top are changed to reflect the current month’s activity, and the production cost report takes care of itself. Teams don’t need all the bells and whistles of a Gantt chart or sheet view, which what are t accounts definition and example is why multiple project views share the schedule and update simultaneously. Track inventory on visual kanban boards and line workers can complete tasks on the list view and stakeholders can get a monthly overview with the calendar view. It’s a measurement to ensure that activities are performed correctly the first time to avoid the need for rework, which takes time and adds costs to production.

8.6 Preparing a Production Cost Report – Weighted Average

On the last day of February, it was only 25% through the process, meaning that the EUs for ending inventory for direct materials was 1,000 units and for conversion costs was 25% of 1,000 units which is 250 EUs. We started with 750 units that were 100% complete as to materials and 60% processed, so the beginning work-in-process EUs for direct materials is 0% of 750 and for conversion costs is 40% of 750 which is 300. Establish the total inventory in production by adding units started into production to beginning work in process (what was left only partially finished at the end of the prior month). The company had 750 shells in process at the close of business on January 31.

Use our secure timesheets to ensure that labor costs align with the budget. Not only do they streamline payroll, but they provide visibility into how far each team member is in completing their tasks. For a high-level overview of production costs, use the real-time dashboard. Production volume measures how many units are manufactured over a specific period. This is a fundamental benchmark for manufacturing efficiency and helps production managers understand the total output the factory can produce. The production volume to be manufactured by an organization should be determined by its production budget.

Moreover, understanding the cost of production is essential for pricing strategies, ensuring that products are competitively priced while still generating a profit. Understanding the intricacies of direct materials and labor costs is pivotal in the manufacturing sector, as these are the primary components that directly contribute to the production of goods. The accurate calculation of these costs not only reflects the efficiency of production processes but also impacts the pricing strategy, profitability, and competitive positioning of a company’s products. From the perspective of a cost accountant, the precision in these calculations ensures the integrity of financial reporting. Meanwhile, production managers view these costs as a measure of operational efficiency, and strategic planners use them to forecast and budget for future production cycles.

Monitoring and controlling that process ensures that deadlines are met and costs aren’t exceeded. One way to keep track of the manufacturing process is with a production report. According to the accounting records, direct materials transferred to the mixing department were costed at $3,575 and direct labor and factory overhead were $3,640. The 750 shells in production at the end of January were 60% complete as to conversion costs and 100% complete as to direct materials, so in February they will need 40% more conversion but 0% more direct materials.

A cost of production report is a document used by manufacturers to calculate the cost of producing goods during a specific period. This report is used to determine the cost of goods sold and to determine the value of inventory. The cost of production report is commonly used in process costing systems where goods are produced through a series of processes and not produced individually. The production cost report for the month of May for the Assemblydepartment appears in Figure 4.9.

These nine materials resulted in 427 million metric tons of CO2 emissions in 2018. Create a free IEA account to download our reports or subcribe to a paid service. Mark P. Holtzman, PhD, CPA, is Chair of the Department of Accounting and Taxation at Seton Hall University. He has taught accounting at the college level for 17 years and runs the Accountinator website at , which gives practical accounting advice to entrepreneurs. The three basic cost behavior patterns are known as variable, fixed, and mixed. Asset restructuring is a process of changing the composition or structure of your assets to improve…